Summary

Founder and Director of Strategic Mortgages Perth, Trent Fleskens, answers some commonly asked questions about mortgages in a podcast episode of The Perth Property Show. He covers topics such as:

- how to capitalise on the first home loan deposit scheme and family guarantors to get you into a property faster;

- what cross-securitisation is (and if it’s right for you);

- how to increase your serviceability to get your home loan approved; and

- how your job title or even how many solar panels you have can affect how much (if any!) Lenders Mortgage Insurance you pay.

Listen to the podcast episode below, or read the transcript to gain these great insights!

Podcast Episode

Episode Transcript

This week we’re going back to basics, answering some of those really fundamental questions about getting a loan, minimising your interest rate and your repayments, minimising the amount of cash you need to put towards a purchase if that’s what you’re after, and identifying those options that help you if you’re struggling with servicing or struggling with equity. Whether it’s your first home, your first investment property, you’ve got too many properties, you cross-securitise… how do we sort that out?

We’re going to answer a lot of those basic questions today. We’ve had a few mortgage-specific questions come into the inbox over the last few months, and I thought we’d amalgamate those on this mortgage broking special edition. So the first question I wanted to address, which is one I’ve seen a few people asking about, is explaining a little bit more on the first home loan deposit scheme.

The first home loan deposit scheme

Now, if you don’t know what the first home loan deposit scheme is, it’s a program brought out by the Federal Government a couple of years ago that essentially provides a number of places – in this financial year it’s 35,000 places nationally – for people who have less than a 20% deposit to be able to enter the market without paying Lenders Mortgage Insurance (LMI).

Now, I’ll explain that a little deeper. For any purchase where the borrower (you) is bringing to the table a deposit of less than 20% of the value of the property they’re looking to purchase, the bank is required to take out an insurance policy on your behalf. Now they’re going to make you pay for that. And that premium can be anything from a couple of grand up to $50,000, depending on what your loan-to-value ratio is and what the loan value is itself.

Now that premium is generally capitalised into the loan, meaning you won’t pay that yourself in cash on settlement of the purchase of the property, but it is something that is a wasted investment unless you can really demonstrate that value for getting in. A lot of people would choose to take that Lenders Mortgage Insurance simply to get in the market, especially when the market is growing. It’s often viewed to be a better decision to just to jump in now at a reasonable price and pay the LMI, than wait another two or three years to save that extra money to get to 20%.

If you don’t want to do that and you don’t want to pay the LMI, the first home loan deposit scheme set up by the federal government is your answer. You can have a deposit as small as 5% of the value of the property and the Federal government will essentially act as a family guarantee for the other 15% to make sure you have that 20% so the bank doesn’t need to take out that LMI (Lenders Mortgage Insurance) policy on your behalf. And the cool thing about it is, unlike Keystart, who are also a low deposit lender, the interest rates available to you are just the same as everyone else who has more than 20%. And most of the big banks that you would recognise around Australia are participating in this scheme.

So you can go to a mortgage broker, say, “Look, I’ve got less than 20% deposit (let’s say I’ve got a 5% deposit), I’ve got $25,000 and I’m looking to buy a $500,000 house. As long as the bank that we end up taking you to agrees that you can service that loan with your income, then you won’t pay Lenders Mortgage Insurance, you will pay the same interest rate as if you had the 20% deposit, and you’ll be in the market – a growing market in Perth right now – faster than you otherwise would have. This decision to go down this path could save you hundreds of thousands of dollars, depending on how long it would have otherwise taken you to save that money.

If not, it at least would have saved you the amount of Lenders Mortgage Insurance that is now being waived. So that’s the first question. What is the first home loan deposit scheme? A couple more pieces of criteria:

- you need to have made a maximum of $125,000 as an individual or $200,000 as a couple;

- you need to be over 18; and

- the maximum price of that property that you’re looking to buy shall be $500,000 for an established house or $550,000 for a new house or a build that you’re looking at.

So there’s a bit of space there, especially if you’re a young person looking to get into the market and savings is your issue. You can ask your mortgage broker to assist you to get into that first home loan deposit scheme program.

Now that helps me segway into the next option for not paying when there’s mortgage insurance. And that is what I mentioned before, a family guarantee.

Family guarantee loans

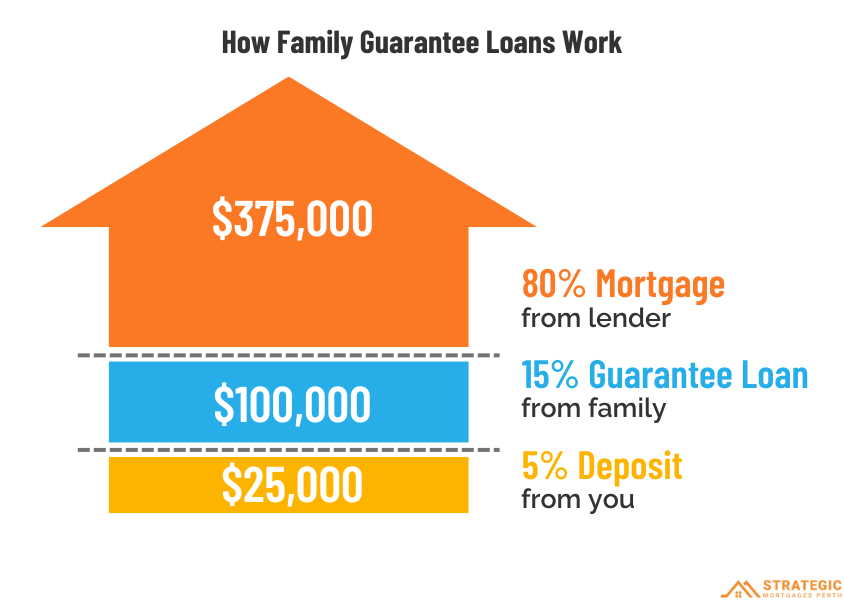

Now, in many ways, this may be an inferior product to the first home loan deposit scheme that is available through the federal government. But if you have a great relationship with your parents and your parents have enough equity in their home, then going to a broker and asking them to assist with a family guarantee loan could be the answer.

Now, the cool thing about this is that with some lenders, you’re actually able to loan 100% of the value of the property. As long as your parents have enough equity in their home below that 80% loan-to-value ratio, you can use that equity as the security for the 20% that you will require for your purchase. And the way it would be set up is as follows.

Let’s say you’re looking to buy a $500,000 property and you only have enough for the stamp duty and fees – let’s say that’s $15,000. You would then take out a $400,000 loan, being 80% of the value of the property, that would be purely securitised by the property you’re buying. The remaining $100,000 loan would be securitised by your property and by your parent’s property. The benefit to your parents is that they’re only securitising $100,000 instead of $500,000. And what’s important to identify in that conversation with your parents is that whilst they are guaranteeing that $100,000 loan, they are not responsible for paying the mortgage – you are.

However, if you don’t, and you can’t get a tenant to assist you with doing that, they will ultimately be responsible for that loan. You’d like to think it would never get to that position. That’s where that great relationship with your parents comes in. Now, the tactic here in a rising market in Perth is that as long as you’ve got the serviceability – the income to service that $500,000 loan – you can get in the market before it keeps running away from you, even without any savings by using your parent’s equity.

And then in that time, the second that property that’s worth $500,000 gets to $620,000, well, at that point in time, that $500,000 loan is now under 80% of the value of the property. Your parents can be released from being a family guarantor and you’ve got that property under an 80% loan-to-value ratio, no Lenders Mortgage Insurance, and away you go.

So in a rising market like this, this is a fantastic strategy for young person to get into the market without any equity as long as they’ve got the income to service that loan.

Now, we’ve got another question coming in around Lenders Mortgage Insurance and how you may have that waived via your job description. That’s a really cool question.

How to waive Lenders Mortgage Insurance with your job description

There are a number of banks out there that offer a waiver on your Lenders Mortgage Insurance if you have a job in an industry that banks find to be low risk. If you have a job in the medical industry – so midwife, nurse, doctor, physiotherapist, any sort of specialist in the medical space – then it’s more than likely you will be eligible for a Lenders Mortgage Insurance waiver.

If you’ve got the income, but you don’t have the 20% deposit plus stamp duty, there are banks out there that a mortgage broker can assist you with to waive that Lenders Mortgage Insurance. And depending on your situation, depending on how financially strong you are and your income, we’ve seen some banks actually lend 100% of the value of the property for clients they’re really chasing after.

There are other banks that also look after people in the legal profession. So a qualified lawyer, a qualified engineer, a qualified accountant, police officers, and quantity surveyors, all of these areas that the banks deem as being very low risk in terms of their clientele. They want you and they are happy to pay that Lenders Mortgage Insurance premium on your behalf to secure you as a client.

I think that’s a great thing to recognise. If you’re in any of these industries, you’re a cop, lawyer, dentist, midwife, nurse, accountant, anywhere in that space, please do reach out if you don’t have a 20% deposit, but you’re looking to buy into Perth’s rising market right now. There are solutions for you, you don’t have to wait.

What is cross-securitisation?

Okay. Next question – “Trent, what is cross-securitisation? Can you please explain it?” Really great question. It’s one that is more relevant, I guess, to people who have got more than one property. Cross-securitisation, or cross-collateralisation as some people will call it, is where you’ve got a loan that is secured by more than one property, or more than one loan secured by more than one property. This starts to become a bit of a spider’s web, especially when you’re looking to sell properties.

If you sell a property and you want to get that profit out, the banks will be revaluing every other property, securitising the loan, and therefore you may not get the cash out that you were expecting if the other properties securitising that loan are not worth what they used to be.

It may not be such a problem in this market, but it can be a problem in the future. So what you want to do is make sure that every time you are looking to buy a second or third or fourth property, if that’s your goal, you’re not simply cross-securitising the last property/properties with the one you’re looking to buy, in order to have the equity to purchase that home.

If you’re not going to use your savings and you’re planning on relying on the equity in your existing portfolio to buy the next property, the way you would do that without cross-securitising is refinancing the loan of your existing properties back up to 80% of the value of those properties. And then taking that cash – as a cash-out – out of that loan account, plopping it into your savings or offset account, and then using that cash separately as the deposit for a new purchase.

This way, every time you take out a loan for a new property, there is only one asset securitising that loan and there will be no interference from other properties/other valuations when you’re looking to do something like subdivide or sell that property in the future. That’s probably the easiest way to explain it. Cross-securitisation = not a great thing to do, especially when you’re looking to have flexibility with your portfolio into the future.

How to improve your serviceability

Okay. Next question is regarding serviceability. If you’re struggling with serviceability – your income is not high enough to get the loan you need to buy the property you’re after – here’s a handy tip. Whilst you may be looking to buy your first home – you want that home to be your principal place of residence – if it’s your servicing that’s holding you back, there is a solution.

That solution is to treat that property as an investment property – make it first an investment property. If you take it to the bank with the proposal that you will stay renting with your parents, or boarding with your parents, or renting in the property you’re currently in, you can use the proposed rent from the house you’re looking to buy to increase your income, which will then increase your serviceability.

This can make a massive difference to your serviceability – it generally is going to be the difference if you can’t afford that loan right now. Adding a proposed rental income to your salary is very likely the answer to having the bank sign-off your ability to service that loan. You can then start that ownership journey of that property as a landlord and sometime in the future when you’re ready, you can kick that tenant out, move in yourself, and now you’ve got an owner-occupied property to move into.

As long as your rental costs or boarding costs are lower than the proposed rent of the house you’re buying, this strategy could very much be the difference for you.

Now let’s segue further into a question I’ve received about the variance in servicing calculators that each bank has.

There are over 40 lenders in Australia that offer hundreds of different products these days. It’s not like the old days where it was just the big four and a couple of others and they’ve all got one policy, one interest rate – whether it’s owner occupier, investor, or principal and interest, and interest only. These days, each of the banks have multitudes of products and there are a number of lenders out there, not just the big four banks.

Inherent in that, is a variation in the way they assess your income and your expenses. A good way to put it, that with the current cash rate and a salary of $100,000 for an individual with no other debt, the difference between the lowest bank servicing level and the highest bank servicing level is over $300,000. In fact, one of the big four banks will only give you around $460,000. One of the non-bank lenders will allow you a loan of over $700,000.

If you’ve been to your bank – you’ve been even to a broker – and they’ve informed you that you aren’t able to service that loan, I would challenge that. Speak to another broker who has the experience to place you with the right lender based on your requirements. Your requirements here being finding a lender that will provide you with a loan required to buy that property you’re after. With a variance so large amongst the lenders in the country these days, it’s important to make sure that if you’ve got your goals of buying that first property or that next property, you don’t take no for an answer the first-time.

Lenders across the country are changing their policy, changing their servicing calculator, and changing their appetite all the time. And just because you received a no from one lender or even five lenders, doesn’t mean there isn’t one who does like your income, does like your situation, and will provide the loan you’re after.

How to find the best mortgage products offered by Australian lenders

Now that helps to segue into the next question regarding the different mortgage products each lender offers. As I said, there is a massive variance between the interest rate of a simple owner-occupied principal and interest loan from a small third or fourth-tier lender with low costs and a higher level of competition versus one of the big four banks who rely on their branding, rely on the extra services they provide, and are not as competitive for your work.

There is at least a one and a half percent difference between the most competitive products out there in the market and the least competitive products. 1 – that will be the difference between your ability to service a loan, but 2 – it will be the difference between you having disposable income at the end of the month and not. Now one loan product that I find really interesting at the moment is a loan product that rewards you for having solar panels on your roof or for living in a house that has a seven-star energy rating.

So if you’ve got solar panels on your roof or you’re living in a house or apartment that’s got a seven-star energy rating, it’s worth asking the question with a mortgage broker, “Can you please tell me the lenders that are providing this massive discount to us who are essentially rewarding you for having these green products”. If you’re looking to refinance, if your current loan with one of the bigger lenders is not as competitive as you think, and you’ve got solar panels or you’re living in a seven-star rated at home, I implore you to have a look at those options with your mortgage broker. That’s pretty exciting, I think, and I hope we start to see a few more products like that coming onto the market,

Because I hope those questions have been relevant to you and those tips have been helpful, if you think some of those options might be worthwhile looking into for yourself, if you’re a first-time buyer or an investor who has been told they’re reaching their serviceability or equity limit, please do get in touch with a competent mortgage broker – I’m sure they’ll be able to help you out.