Choosing the right mortgage broker in Perth can make all the difference when it comes to securing the most suitable loan for your goals. Whether you’re a first-home buyer, refinancing an existing loan, or building a property portfolio, the right broker will help you navigate complex lending policies, lender differences, and WA’s unique property landscape with confidence.

Perth’s market is competitive and fast-moving, and the loan you choose today can shape your finances for years to come. That’s why it’s worth taking the time to find a broker who understands more than just interest rates, someone who understands your strategy.

Key Qualities to Look For in a Perth Mortgage Broker

1. Accreditation and Experience

Your broker should be a fully accredited member of industry associations like the MFAA or FBAA and licensed with ASIC. These credentials ensure they follow industry best practices and act in your best interest.

Just as important is their track record. An experienced broker brings valuable insights from working with a variety of lenders and client situations. They can help you pre-empt issues, structure your loan for future flexibility, and communicate with banks more effectively, especially if you’re self-employed, have a low deposit, or need creative finance solutions.

2. Access to a Wide Panel of Lenders

The more lenders your broker can access, the better your chances of securing a competitive rate and loan product tailored to your circumstances. Ideally, they should work with at least 20 to 30 lenders across banks, credit unions, and non-bank providers.

Strategic Mortgages has access to over 30 lenders, including major banks and specialist lenders.

3. Local Market Knowledge

The Perth property market operates differently to other Australian capitals. A broker who lives and works locally understands what banks look for in different suburbs, how property types can affect lending, and how seasonal trends influence buyer behaviour.

This knowledge helps you avoid delays and gives you an edge when competing for properties, particularly in low-supply areas.

4. Strategy-First Advice (Not Just Rates)

Many buyers get caught up chasing the lowest rate, but the cheapest loan isn’t always the most suitable. A smart broker looks at your long-term goals, exit strategy, cash flow needs, and risk profile. They’ll help structure your loan with features like offset accounts, redraw facilities, or a fixed/variable split that complements your broader financial picture.

They’ll also advise you on how to reduce fees, avoid unnecessary Lenders Mortgage Insurance (LMI), or access government assistance schemes when available.

5. End-to-End Service and Support

A great broker won’t just lodge your application and disappear. They’ll assist with document preparation, liaise with the lender, explain bank terms in plain English, and manage everything through to settlement.

And the support doesn’t stop there. Your broker should check in regularly to help you assess whether your current loan still suits your evolving needs.

Essential Questions to Ask Before Choosing a Broker

Not all mortgage brokers operate the same way. Some are strategic partners for the long haul, others are just ticking boxes. To avoid costly missteps, it’s worth asking the right questions upfront. These will help you understand whether the broker is qualified, transparent, and focused on your long-term success.

- How many lenders do you work with?

- Are you accredited and licensed with ASIC?

- How are you paid — commission or fixed fee?

- What’s your process for matching clients with the right loan?

- Have you worked with buyers like me (e.g. first-home buyers, investors, business owners)?

- Can you walk me through your loan application process?

- What support do you offer after the loan settles?

Need a broker that ticks every box? Connect with our Perth home loan team.

Red Flags to Watch Out For

A mortgage broker should make the process easier, not riskier. Unfortunately, some brokers put commissions or convenience before your needs. By keeping an eye out for these red flags, you can avoid poor advice, wasted time, or a loan that doesn’t actually serve your goals.

Choosing the wrong broker could cost you time, money, or even loan approval. Watch for these warning signs:

- They push only one lender without showing comparisons

- They can’t (or won’t) explain how they’re paid

- They’re evasive about licensing and qualifications

- They don’t ask about your financial goals or personal circumstances

- They make unrealistic promises (e.g. “guaranteed approval”)

- They provide overly general or vague advice

A good broker will be upfront, clear, and focused on your best interests — not theirs. They should also have readily available, consistent, and reliable information showcasing their expertise like our Perth Mortgage and advice guides here.

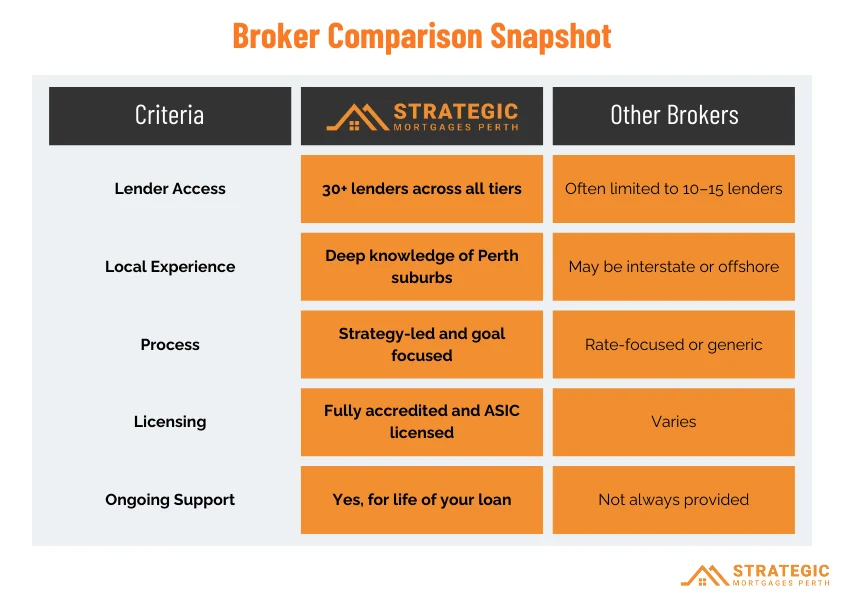

Broker Comparison Snapshot

Still weighing up your options? This quick side-by-side comparison shows how Strategic Mortgages Perth stacks up against many other brokers. From lender access to local knowledge, it’s not just about who can get you a loan, it’s about who can get you the right one, with a smarter strategy behind it.

Broker Comparison Snapshot

Frequently Asked Questions About Choosing a Mortgage Broker in Perth

Why should I use a mortgage broker instead of going directly to a bank?

A mortgage broker gives you access to a wider range of loan options across multiple lenders, not just one bank’s products. At Strategic Mortgages Perth, we compare loans from over 30 banks and non-bank lenders, giving you more flexibility, better rates, and features that match your personal goals. We also do all the legwork, saving you time and avoiding the need to repeat your application process over and over again.

What makes a good mortgage broker in Perth specifically?

A good Perth broker knows the local property market, understands WA lending policies (which can differ from the east coast), and has strong relationships with lenders who operate in the region. We’ve helped hundreds of Perth buyers, refinancers and investors by providing personalised loan strategies tailored to the WA property environment.

How do I know if a broker is truly independent?

An independent broker will work with a large panel of lenders and won’t push just one option without showing comparisons. Ask them how many lenders they work with, whether they’re paid the same across different banks, and whether they can justify their recommendation with evidence. At Strategic Mortgages, we offer full transparency on this upfront.

Can a broker help me if I’ve already spoken to a bank or been declined?

Yes. In fact, many of our clients come to us after struggling with bank approvals. We understand the specific credit policies of different lenders and can often find an option that better fits your situation, whether that’s income type, deposit size, or a past credit issue. Our goal is to help you get the right loan, not just any loan.

Do mortgage brokers help with pre-approvals?

Absolutely. Getting a strong, reliable pre-approval is one of the most important first steps in your property journey. We guide you through what documents you’ll need, how long approvals take, and which lenders offer the most accurate and reliable pre-approvals, not just marketing fluff.

Do you only work with first-home buyers?

No — while we love helping first-time buyers, we also work with homeowners looking to refinance, as well as seasoned investors building or restructuring property portfolios. Whether it’s your first loan or your fifth, we tailor the strategy to your stage of life and long-term financial goals.

Can you still help if I’m self-employed or have irregular income?

Yes. We work with lenders who understand complex income structures, whether you’re self-employed, a contractor, or a small business owner. We can guide you through what documents you’ll need and which lenders are most flexible with alternative income types.

How long does the mortgage process take from first call to approval?

It depends on the lender and how prepared you are with your documents, but generally:

- Pre-approval can take 2–5 business days

- Formal approval usually takes 5–10 business days once a full application is submitted

We’ll keep you updated every step of the way and make the process as stress-free as possible.

Conclusion: Choose Strategy Over Sales

Your mortgage is one of the biggest financial commitments you’ll ever make. Choosing a broker who prioritises strategy over sales, who understands your goals, and who walks with you through the full journey can make all the difference.

At Strategic Mortgages Perth, we believe in clear advice, long-term support, and delivering results, not empty promises. Whether you’re buying your first home, refinancing, or investing, we’re here to guide you through every step.

Book your free strategy call and let’s get started.