How Does Equity Release Mortgage Work?

Equity release mortgage is a financial product that allows homeowners, typically of retirement age, to unlock the wealth tied up in their property without having to sell up or move out. This can be done either by taking out a loan against your home or by selling all or part of it in exchange for a lump sum or regular income.

Learn how to leverage the equity in your Perth home to fund your investment dreams with our quick ‘Short Cuts’ video below, or read on for a deeper understanding of the power of equity release to make strategic property investments.

Understanding Home Equity: Your Hidden Investment Asset

If you’ve found yourself as a homeowner in Perth, chances are that you’ve been keeping an eye on the value of your property. Over the years, as property values have risen, so has the equity in your home. But what exactly is equity, and how can you leverage it to achieve your financial goals, such as purchasing an investment property?

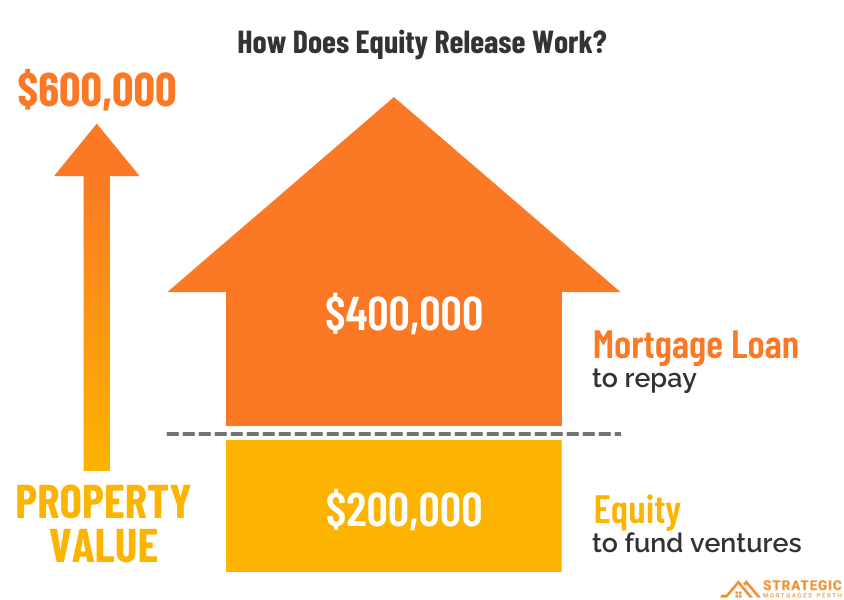

Equity, in simple terms, is the difference between the current market value of your property and the outstanding balance on your mortgage. For instance, if your home is currently valued at $600,000 and you owe $400,000 on your mortgage, your equity is $200,000. This equity can be a valuable asset that you can tap into to fund other ventures, such as investing in real estate.

Leveraging Equity Release for Strategic Property Investments

Let’s say you’re eyeing an investment property worth $500,000. To avoid paying Lenders Mortgage Insurance (LMI), typically required for loans with less than a 20% deposit, you’d ideally want to have $100,000 in equity, plus an additional $25,000 for other costs. That totals $125,000—a significant sum for many homeowners.

How does an equity release mortgage work?

The Power of Equity Release with a Perth Mortgage Broker

Accessing Equity Through Cash-Out Refinancing

If you don’t have this amount readily available in savings, you can turn to the equity in your home. If the value of your property has appreciated over time, there’s a good chance you have accumulated enough equity to make this possible. This process involves what’s known as equity release, where you extract cash from the value of your property through a cash-out refinance.

To execute this strategy, you’ll need the expertise of a reputable mortgage broker in Perth. They’ll help you navigate the process of releasing equity, also known as a cash-out refinance, by adjusting your loan-to-value (LTV) ratio back up to 80% on your original home. By doing so, you can access the cash difference between your property’s current value and its original mortgage balance.

Building Wealth with Investment Properties in Perth

This cash can then serve as the deposit for your investment property, allowing you to enter the real estate market without depleting your savings entirely. With the guidance of a skilled Perth mortgage broker, you can optimise your financial position and make strategic moves to build wealth through property investment.

Equity Release Mortgages: A Smart Move for Perth Homeowners

In conclusion, equity release offers homeowners in Perth a valuable opportunity to leverage the appreciation of their property values to achieve their investment goals. By partnering with knowledgeable Perth home brokers, you can unlock the equity in your home and embark on your journey towards building a diversified and prosperous investment portfolio.