Have you been rejected for a home loan in Perth because your bank or broker told you that your income isn’t enough to borrow the amount you need? You’re not alone and you might have more options than you think.

What many people don’t realise is that your borrowing capacity can vary significantly between lenders. On an income of over $100,000 per year, the difference between the bank that offers you the least and the one that offers the most can be over $300,000.

In a competitive housing market like Perth, especially with rising construction costs and limited property supply, that difference can determine whether you build your dream home, get a new investment property, or settle for second best.

Why Borrowing Power Varies So Much

If you’re wondering, “how much can I borrow?” the answer depends on more than just your salary. Each bank uses a different method to assess your loan application. These include:

- Living expense benchmarks based on your family size and lifestyle.

- How they treat other debts, including unused credit card limits.

- Assessment rate buffers, which are often 2–3% above the actual loan rate.

- Income treatment, such as how they view overtime, bonuses, commissions, or self-employment income.

- Rental and investment income policies.

- Loan type, such as first home or investment.

One lender might use conservative assumptions that dramatically reduce your borrowing capacity. Another may assess the same financials more generously and approve a loan hundreds of thousands higher.

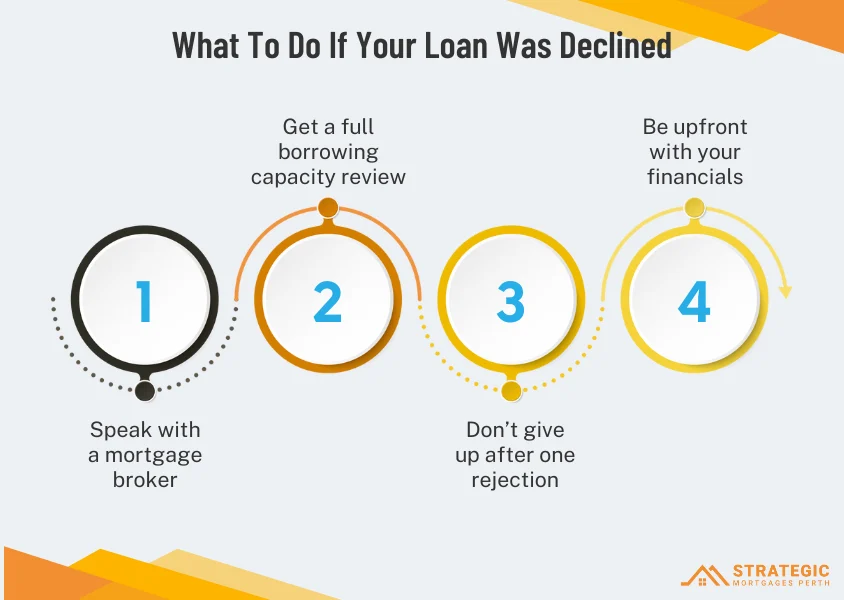

What To Do If Your Loan Was Declined

If your bank said you don’t qualify, here’s what to do next:

- Speak with a mortgage broker in Perth who works across multiple lenders, not just one.

- Get a full borrowing capacity review that compares how different lenders assess your income and expenses.

- Don’t give up after one rejection.

- Be upfront with your financials so you can be matched to a lender that understands your situation.

Your Borrowing Power Deserves a Second Opinion

At Strategic Mortgages Perth, we don’t rely on guesswork. We run detailed assessments across more than 30 lenders to help our clients unlock the maximum they can borrow — whether they’re buying their first home or growing their investment portfolio.

If you’re searching for a home loan in Perth and want to know how much you can really borrow, we’re here to help. Even if your loan was rejected by a bank, we may be able to get you approved with a better-suited lender.

To find out your true borrowing power in today’s market, speak with our team of leading perth mortgage brokers.