Buying a home, refinancing, or investing in property? It’s easy to feel overwhelmed by all the options, banks, and fine print. That’s where a mortgage broker comes in, and at Strategic Mortgages Perth, we’re here to help you make sense of it all.

Whether you’re a first-time buyer or a seasoned investor, understanding what a mortgage broker actually does (and how we can help you) is key to making smarter, more confident decisions with your money.

Let’s break it down.

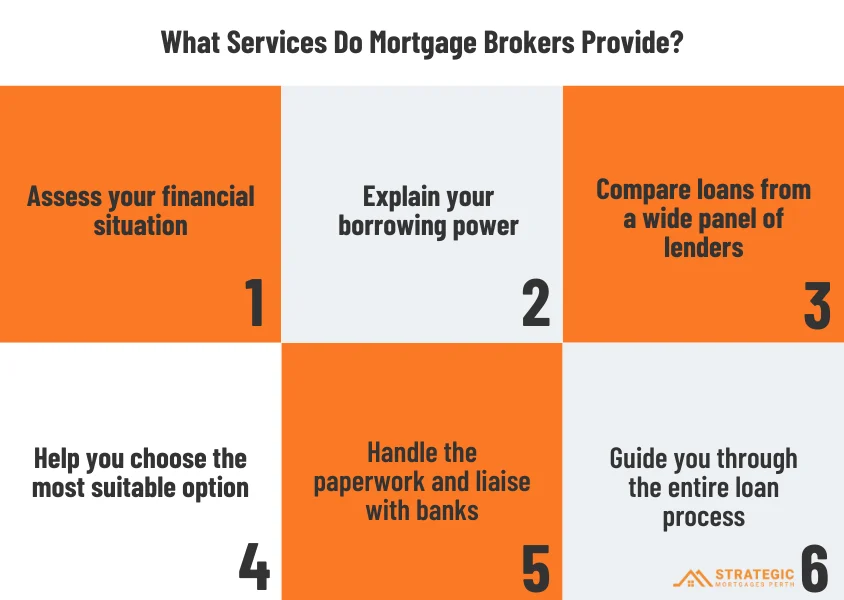

What services do mortgage brokers provide?

Experienced mortgage brokers assess your financial situation, compare loans from a wide panel of lenders, and help you choose the most suitable option. They explain your borrowing power, handle the paperwork, liaise with banks, and guide you through the entire loan process – from pre-approval to settlement. Accredited and licensed under ASIC, professional brokers also offer ongoing advice to support your financial goals beyond the initial loan.

At Strategic Mortgages Perth, we:

- Assess your finances and borrowing power

- Compare rates and features across a panel of lenders

- Handle all the paperwork and follow-ups with the bank

- Provide strategy-led advice (not just the lowest interest rate)

- Help you avoid costly mistakes or unsuitable loan structures

And unlike going direct to a bank, you get more choice, better strategy, and one-on-one guidance tailored to your needs.

We’re More Than Just Home Loans

At Strategic Mortgages, we’ve built our reputation on clear advice and practical results. That means looking beyond the numbers and making sure every loan decision supports your bigger financial picture. Whether you’re stepping into the market for the first time or fine-tuning a growing portfolio, we offer tailored solutions that align with your goals, not just the lowest rate. Our services cover:

First Home Buyers

Buying your first home is exciting, but it can also be one of the most confusing and stressful financial decisions you’ll ever make. From figuring out how much you can borrow to navigating loan types and government incentives, it’s easy to feel overwhelmed. That’s why we take a hands-on, education-first approach. We’ll help you:

- Understand your true borrowing capacity based on your income and lifestyle

- Work out how much deposit you really need (hint: it might be less than you think)

- Explain options like LMI (Lenders Mortgage Insurance), parental guarantees, and shared equity

- Identify and apply for government schemes, including the First Home Guarantee and First Home Owner Grant (FHOG)

And importantly, we’ll walk you through the loan process from pre-approval to settlement in plain English, without the jargon. Click here to learn more about our home loans

Refinancing Your Home Loan

Refinancing isn’t solely about chasing a lower interest rate , it’s about making your money work smarter. Whether you want to reduce your repayments, tap into equity, consolidate debt, or simply tidy up an old loan, we can help you find a solution that fits.

We’ll assess your current loan and compare it against a wide range of lenders and products to see what’s possible. Then we’ll guide you through:

- Whether refinancing will save you money after fees and charges

- Unlocking equity for renovations, investments or major life goals

- Consolidating high-interest debt into your mortgage

- Switching to better features like offset accounts, redraw, or flexible repayments

Refinancing at the right time can save you thousands, but doing it with the wrong structure or without a clear strategy can cost you more long-term. That’s where we step in.

Property Investment Loans

Investment lending requires a different approach than standard home loans, and we’ve helped hundreds of Perth investors build smarter portfolios with better loan structures.

Whether you’re buying your first investment property, expanding your portfolio, or needing to restructure to maximise tax benefits or borrowing power, we offer strategy-led advice based on real-world experience.

We help you:

- Choose between interest-only vs principal and interest repayments

- Decide whether to fix or split your loan based on market conditions

- Access offset accounts and redraw to boost cash flow

- Avoid common pitfalls like cross-collateralisation that can limit flexibility

- Tap into equity from existing properties to fund your next purchase

With the right setup, your property portfolio can support your long-term financial goals, not hold you back. Explore our investment mortgage broker services

Why Work With Strategic Mortgages Perth?

Here’s what makes us different:

- Independent and local: We’re not tied to any lender and we know the Perth market inside out.

- Strategy-first mindset: We don’t just chase rates, we plan for your long-term success.

- Real advice: We take the time to explain things clearly so you can make confident decisions.

- No fee for most services: We’re paid by the lender, not you, and we’ll always be upfront about any costs involved.

From application to approval, you’ll have a real person in your corner who understands the Perth property market and will advocate for your best interests.

How to Know If You Need a Broker

Still wondering if you need a mortgage broker? If any of these sound like you, we can help:

- You’ve been declined by a bank and don’t know why

- You’re unsure how much you can borrow

- You’re juggling multiple debts and want a clean slate

- You want to grow your property portfolio but need the right structure

- You’re overwhelmed by rate changes and refinancing options

Let’s Talk Strategy

When it comes to mortgage broker services in Perth, here at Strategic, believe smart lending starts with smart planning. Whether you’re buying your first home, refinancing your current one, or building a long-term investment plan, we’ll help you map out a strategy that fits your goals.

Ready to get started? Book a free strategy call with us today.