The Investment Property Path to Your First Mortgage

How To Get Your First Perth Mortgage

For many Western Australians, particularly in Perth’s increasingly competitive property market, the dream of home ownership can seem frustratingly out of reach. While property prices continue their upward trend, one of the biggest hurdles first-home buyers face isn’t necessarily saving for the deposit – it’s having sufficient income to service their first Perth home loan.

However, there’s a lesser-known strategy that could help you enter the property market sooner rather than later.

Discover the tip in our ‘Short Cuts’ video, or read on to learn more about this strategy.

The Investment Property Trick to Your First Mortgage

The trade trick to getting your first mortgage as early as possible? Buying your first property as an investment rather than as your primary residence.

While somewhat counter-intuitive to traditional home-buying wisdom, this approach offers several advantages that could make the difference between entering the market now or getting stuck waiting years for your income to increase.

How it Works

The concept is simple yet powerful: rather than purchasing a home to live in immediately, opt for an investment property that you can rent out while you continue living with family or in a more affordable rental. By doing so, you can utilise the projected rental income from the property to enhance your overall income and improve your loan serviceability.

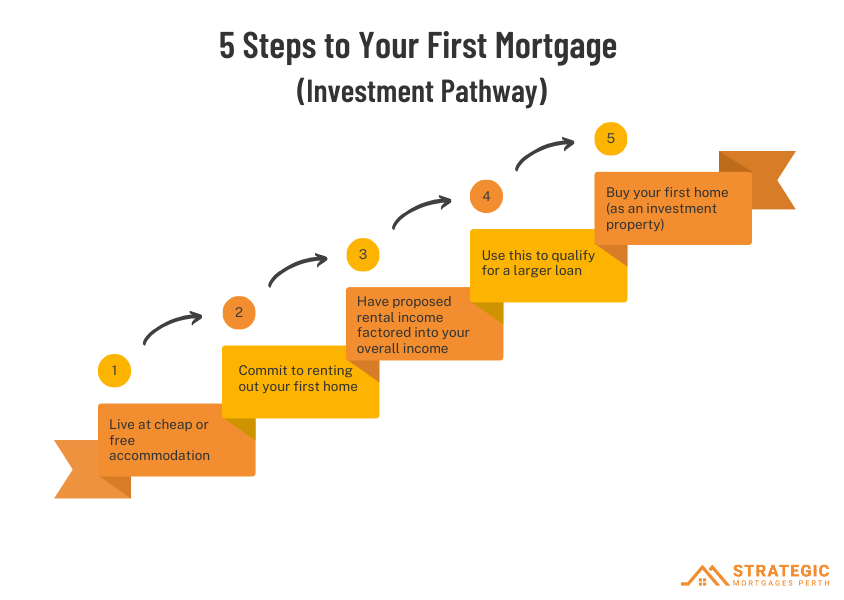

To make it easy to understand, we’ve broken it down into five simple steps:

- Instead of immediately moving into your first property purchase, commit to living with family, or at an affordable rental, for the time being.

- Under this scenario, you would be able to earn rental income if you owned an investment property.

- Then, when you go to purchase an investment property, your proposed rental income can be factored into your loan serviceability calculations. This will boost your income in the eyes of lenders.

- Under these calculations, you can qualify for a larger loan, to use in buying your first investment home.

- You then have the choice of saving for a second, owner-occupied home, knowing you are not falling behind in the market. Or, you can choose to transform this home into an owner-occupied residence, once you have additional income.

Example

Let’s say you’re looking at a $500,000 property. You have over $100,000 saved, easily clearing your 20% deposit, but your current income isn’t enough to service a loan large enough to fill the full 80% gap.

If that property could generate $450 per week in rental income (approximately $23,400 per year), lenders will typically consider a portion of this rental income – usually around 80% – when assessing your loan application. This additional income could be enough to push your application over the line and acquire your first home.

Benefits of Buying an Investment Property for Your First Home Loan

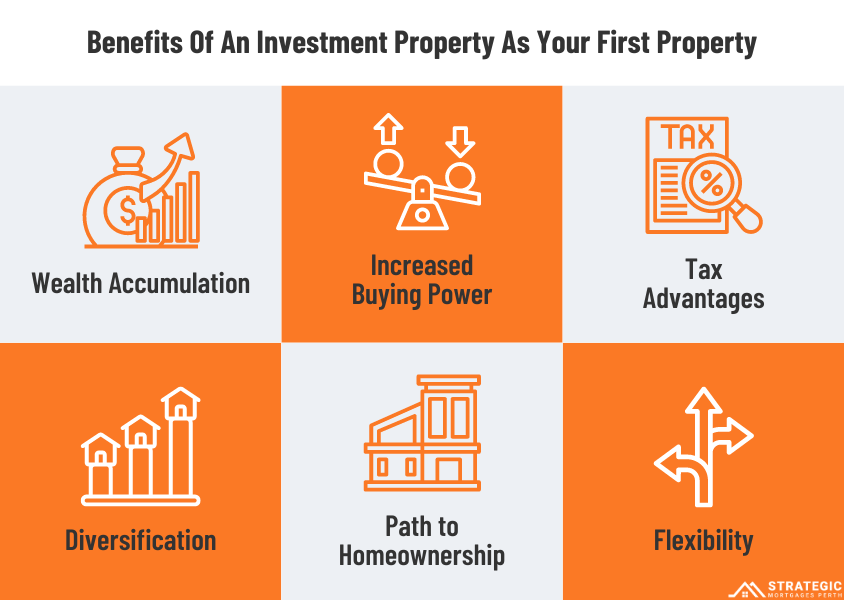

1. Experience Increased Buying Power

This approach provides you with increased buying power that let’s you into the market early, giving you an opportunity to further build your income and capital. With home prices continuing upward, having this increased buying power allows you to stop trying to catch-up to the property market, with your foot already in the door.

The additional rental income adds a crucial boost to your financial profile, bridging the gap between your existing income and the necessary threshold for loan approval.

2. Start the Path to Long-Term Wealth

Starting your home ownership journey with an investment property not only provides a practical solution to affordability challenges, but it also sets you on the path towards building wealth through property investment. The rental income generated from your investment property can serve multiple purposes, from supplementing your existing income to covering mortgage repayments and other expenses associated with home ownership.

3. It Works in the Perth Market

In Perth’s current rental market, where vacancy rates are tight and rental yields are strong, holding an investment property puts you into a strong income position. Many suburbs, particularly in the middle and outer rings of Perth, are achieving high rental yields which can help you to meet mortgage repayments.

4. You Receive Future Flexibility

This strategy allows you to not only move into the market early, but also provides flexibility for the future. While there is risk involved, this strategy can help you build equity in the long-term. After a period of building equity, you can then make the choice to either move into the property yourself (converting it into a primary residence) or use the equity you’ve built to purchase a different property to live in while maintaining your investment.

If you are still early in your career, then you may find that within a few years, your income has risen sufficiently to allow you to buy a owner-occupied home to live in. Then, you will be ahead of the curb with an investment which could be the start of a growing portfolio.

5. Tax Advantages

Investment properties can provide substantial tax advantages such as deductions for mortgage interest and property taxes.

The exact advantages that you may be eligible for vary depending on your situation, location and property. To find out what advantages you may acquire by selecting an investment property for your first home, we recommend speaking with an experienced Property investment broker, who can give you inside expertise.

6. Diversification

By owning a investment property you are given the opportunity to diversify your capital portfolio early, allowing you to spread risk with the potential for increase returns.

Key Considerations

While this is a legitimate option for first home ownership, ensure that you carefully consider all factors before making a decision to buy an investment property as your first home. Key questions to ask yourself include:

- Where will I stay in the interim while I am renting my home out? Is this sustainable for me long-term?

- How long might it take until I have the income to move into the home myself?

- Am I prepared for the responsibilities of a landlord? This includes upkeep and maintenance fees for the property as well as potential advertising and management fees.

- Do I feel comfortable with this risk? While property in Perth has been strongly, and steadily, increasing, property values and rental yields may fluctuate.

Navigating the Path to Your First Home Loan with Expert Guidance

With multiple potential outcomes, risks and pathways to home ownership, it’s hard to know what the right decision is.

Thankfully, it’s a choice you don’t have to make alone. As Perth’s trusted investment mortgage brokers, we’ve helped others just like you make the right decision for their first home. We take into consideration your personal and investment goals, financial situation and current needs, to come up with a plan for home-ownership which is tailored to you. Holding relationships with over 30 lenders, we not only help you select the best option, we help make the best options available to you.